Changing your tax domicile in Portugal is an essential step for those moving to the country and wishing to regularize their tax situation. This article will guide you through the process, from obtaining a Tax Identification Number (NIF) to updating your address on the Financial Portal.

Why is it important to change your tax domicile in Portugal?

When obtaining a NIF (Tax Identification Number), it’s common to assign a tax representative and register an address outside of Portugal, usually in your home country. However, after residing in Portugal for more than 183 days, you are considered a tax resident, which implies the obligation to pay taxes in the country. Updating your tax address is crucial to comply with tax regulations and avoid potential penalties.

Furthermore, once you’re working in Portugal, you’ll need to file your IRS tax return. The IRS rate for residents starts at 14.5%, while the IRS rate for nonresidents starts at 25%. This is a significant difference in the amount you’ll have to pay, so don’t forget to change your foreign address to one in Portugal.

First change of tax domicile: from abroad to Portugal

The first change of tax domicile, from a foreign address to one in Portugal, requires certain documents and a specific procedure.

Essential requirement to change the tax address

To make the first change of tax address (from abroad to Portugal), you must have a valid Portuguese residence permit , i.e., your residence card . For European citizens, you must have a European Citizen Registration Certificate (

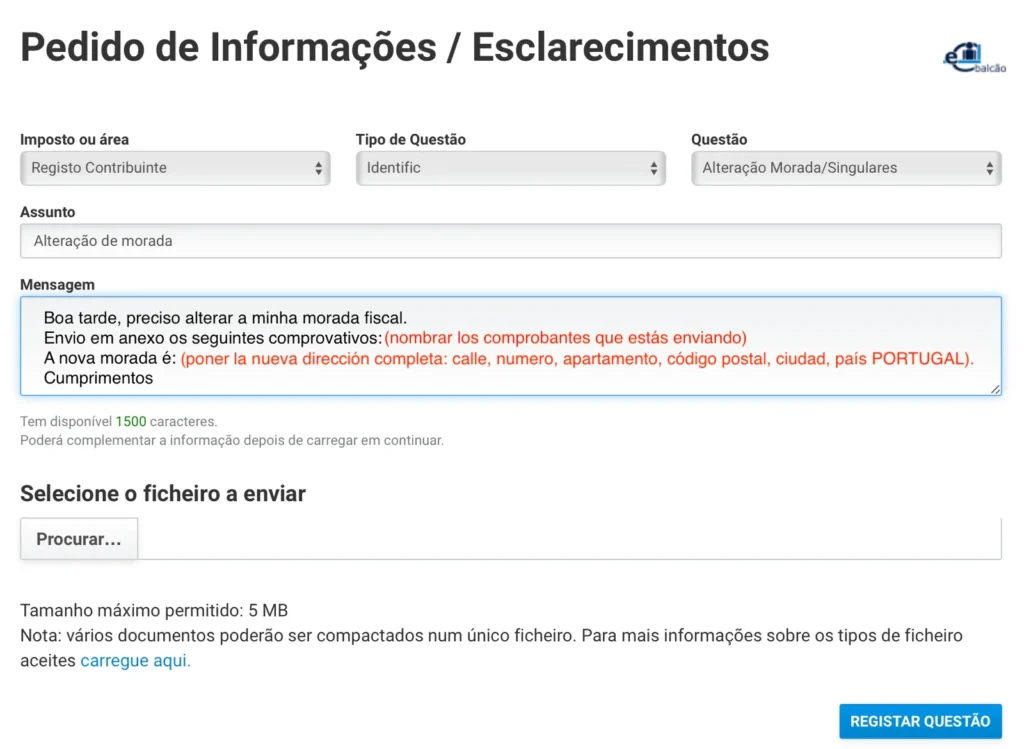

This change is made online through the e-Balcony , within the Financial Portal . Below, we explain how to do it step by step.

Step-by-step instructions for changing your tax domicile to Portugal

- Access the Financial Portal : Log in with your NIF and password.

- Search for “e-balcão” : Use the search bar to find the online support service.

- Register a new query : Click on “Register New Questão”.

- Complete the required fields :

- Tax or area : Select “Taxpayer Registry”.

- Question Type : Choose “Identify”.

- Question : Select “Alteração Morada/Singulares”

- Adjunta la documentación necesaria: Incluye un único archivo PDF que contenga:

- Proof of address in Portugal : Lease agreement, utility bill in your name, etc.

- Additional documentation : Residence permit, EU Citizen Registration Certificate (CRUE), as applicable.

- Submit your request : Click “Registar Questão” to submit your request.

You will receive a response within a few days. If the documentation is accepted, you will be sent a PDF document to sign (it can be a digital signature). You must reply to the message, attaching the signed document. After that, you will be sent a PDF version of your NIF (Tax Identification Number) with your new address.

⚠️ It’s important to check your e-Balcony directly, as if you don’t have notifications enabled, you won’t receive email alerts . If your request is rejected, you can try again or visit a Finanças branch in person.

✉️ Tip: If you submit another request, another official may respond and approve it, as each request is reviewed by a different person.

What about the tax representative?

Once the change of tax domicile to an address in Portugal is approved, tax representation is automatically eliminated , as it is only necessary while you reside abroad.

Change your tax address within Portugal (between two Portuguese addresses)

Once your tax domicile is registered in Portugal, changing your address within the country is easier:

- Access the Financial Portal : Log in with your NIF and password.

- Search for “alter address” : Use the search bar to find the address change option.

- Enter your new address : Fill in the fields with your new address and confirm the request.

- Confirm the change : You’ll receive a letter at your new address with a confirmation code. Log back into the Financial Portal, search for “Confirm Address,” and enter the code you received.

This process ensures that your tax address is up to date and reflects your current residence in Portugal.

Do you need proof of tax address?

Once you’ve updated your address, you can download a “Certidão de domícilio fiscal” (Fiscal Domicile Certificate) from the Financial Portal. This document may be required to open a bank account, register, or complete official procedures.

✅ If you don’t yet have your Portuguese NIF, you can apply for it easily and securely through our NIF application service .

✉️ And if you’re interested in learning more about procedures and taxes in Portugal, visit our Hello Portugal blog .

1 thought on “How to change your tax domicile in Portugal”

hey there and thank you for your information – I’ve certainly picked

up something new from right here. I did however expertise

several technical issues using this site, since I

experienced to reload the site a lot of times previous to I could

get it to load properly. I had been wondering if your web host

is OK? Not that I’m complaining, but slow loading instances times

will often affect your placement in google and could damage your high quality score if ads and

marketing with Adwords. Anyway I am adding

this RSS to my e-mail and can look out for a lot more of your respective exciting content.

Make sure you update this again soon.